About Us

Who We Are

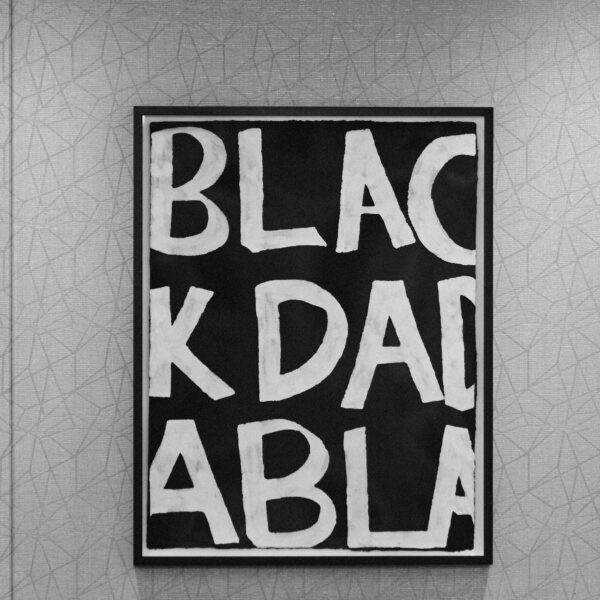

A private asset management firm affiliated with Ariel Investments, LLC. Our first mission, Project Black®, will scale sustainable minority-owned businesses which will serve as suppliers-of-choice to Fortune 500 companies.

What We Do

We invest in middle-market companies, transforming these entities into certified minority business enterprises, and forging a new class of Black, Latino and Latina entrepreneurs.

Why We Do It

Fortune 500 companies currently direct an average of only 2%, or $125 billion, of total spend to minority-owned businesses. We aim to close the wealth gap from the entry level to the boardroom.

Today’s societal demands call for pragmatic business solutions to address widespread economic inequality. It is time to stop admiring the problem.

Our Approach

We take an urgent approach to patient investing.

Solving inequality means building businesses, not simply buying and selling companies.

A long-term strategy allows us to scale sustainable minority enterprises.

Our Impact

Ariel Alternatives’ Project Black® will help Fortune 500 partners achieve supplier diversity and corporate citizenship impact goals.

Through our portfolio companies, we will empower diverse leadership and workforces, create jobs, and offer employee equity ownership.

We will direct a portion of our profits to philanthropic organizations dedicated to equality and civil rights.